10 Powerful Steps to Master the Stock Market for Beginners

Step 1: Understand the Basics of the Stock Market for Beginners

The stock market is a complex system where shares of publicly-traded companies are issued, bought, and sold. To some it is a nebulous, dark chasm where people gamble. Actually, it is not gambling at all. Let’s take a closer look at what you need to know about how stocks are traded.

Step 2: Set Clear Investment Goals

Before you invest in the stock market for beginners, you need to set clear investment goals. What do you want to achieve with your investments? Are you saving for retirement, for future college expenses, to purchase a home, or to build an estate to leave to your beneficiaries? Before investing, you should know your purpose and the likely time in the future you may have need of the funds.

Step 3: Understand the Difference between Stocks and Bonds

The stock market for beginners means understanding the difference between stocks and bonds. This is important because each type of investment has its own characteristics and carries different risks and rewards.

Step 4: Learn about Different Types of Investments

When it comes to learning about the stock market for beginners, there are many different types of investments that you can make. These include stocks, bonds, mutual funds, ETFs, real estate, and other investment vehicles. Each of these has its own level of risk and reward.

Step 5: Choose the Right Investment Strategy

Choosing the right investment strategy is crucial when looking to invest in the stock market for beginners. This will depend on your personal financial goals and how much risk you’re willing to take.

Step 6: Diversify Your Portfolio

One of the most important rules of investing is to diversify your portfolio. This means spreading your investments across various asset classes to reduce risk. If one investment performs poorly, others may perform well and offset the loss.

Step 7: Stay Committed to Your Plan

Many look to invest in the stock market for beginners requires commitment. It’s important to stick with your plan and not let emotions drive your decisions. The stock market will go up and down, but over the long term, it has historically trended up.

Step 8: Regularly Review and Adjust Your Portfolio

As you gain experience in the stock market for beginners, it’s important to regularly review and adjust your portfolio. This will help ensure that your investments continue to align with your financial goals.

Step 9: Consider Getting Professional Help

If you’re new to investing, you may want to consider getting professional help. A financial advisor can help you understand the stock market for beginners and guide you towards making informed investment decisions.

Step 10: Keep Learning and Stay Informed

The stock market for beginners can be a complex place, but with a bit of knowledge and persistence, you can see a great return on your investment. Keep learning, stay informed, and don’t be afraid to take risks. After all, every investor started somewhere.

A Deeper Dive

1. The stock market is where investors buy and sell shares of publicly traded companies. It serves as a platform for companies to raise capital and for individuals to invest their money in hopes of generating returns.

2. For beginners, understanding the stock market provides a gateway to wealth accumulation and financial security. It offers opportunities to grow savings through capital appreciation and dividends.

3. By investing in stocks, beginners can participate in the growth of successful companies and benefit from their profits over time. This can lead to significant wealth accumulation and financial independence.

4. Additionally, the stock market allows investors to diversify their portfolios, spreading risk across different industries and asset classes. This helps mitigate the impact of economic downturns or company-specific issues.

5. Beginners should pay attention to the stock market as it offers valuable insights into the overall health of the economy. Market trends and indicators can signal potential opportunities or risks for investors.

6. Monitoring the stock market enables investors to make informed decisions about buying, selling, or holding their investments. This helps them navigate market volatility and capitalize on profitable opportunities.

7. Moreover, understanding the stock market empowers individuals to take control of their financial futures. It provides a means to grow wealth and achieve long-term financial goals.

8. Beginners should educate themselves on fundamental investment principles, such as risk tolerance, diversification, and asset allocation. This knowledge helps them make sound investment decisions aligned with their financial objectives.

9. Keeping abreast of market news, company earnings reports, and economic indicators can aid investors in making informed decisions. Staying informed allows them to react swiftly to changing market conditions.

10. It’s essential for beginners to adopt a disciplined approach to investing, focusing on long-term growth rather than short-term fluctuations. This mindset helps them withstand market volatility and achieve consistent returns over time.

11. In addition, beginners should consider seeking guidance from financial advisors or experienced investors to develop investment strategies tailored to their goals and risk tolerance.

12. Ultimately, paying attention to the stock market can significantly impact an individual’s personal finance by providing opportunities for wealth accumulation and financial security. With knowledge, discipline, and informed decision-making, beginners can harness the potential of the stock market to build a prosperous financial future.

Stock Market for Beginners: The stock market is a platform where investors buy and sell shares of publicly traded companies. It provides an avenue for individuals to invest their money in hopes of generating returns and participating in the growth of successful businesses.

Usefulness: For beginners, understanding the stock market is crucial for wealth accumulation and financial security. It offers opportunities for capital appreciation, dividends, and portfolio diversification, enabling individuals to grow their savings over time.

History and Need: The stock market traces its origins back centuries to trading activities in ancient civilizations. It evolved to meet the needs of companies seeking capital and individuals looking for investment opportunities, fostering economic growth and wealth creation.

Future Outlooks: The future of the stock market for beginners holds promise with advancements in technology and increased access to information. However, it may also present challenges such as market volatility and regulatory changes that beginners need to navigate.

Impact on Financial Markets: The stock market plays a significant role in the broader financial markets, influencing economic trends and investor sentiment. Fluctuations in stock prices can impact consumer confidence, corporate investment decisions, and overall economic stability.

Hurdles: Beginners face various hurdles when navigating the stock market, including understanding complex financial concepts, managing emotions during market fluctuations, and avoiding common pitfalls like speculative trading or following investment fads.

Stock Market for Beginners: The stock market can be daunting for beginners, but it’s also a gateway to wealth accumulation and financial security. Understanding its fundamentals is crucial for those embarking on their investment journey. Beginners should grasp the basics of how the stock market operates, including concepts like stocks, exchanges, and trading mechanisms. They should also familiarize themselves with the various investment vehicles available, such as stocks, bonds, and mutual funds.

Usefulness: The stock market offers several benefits for beginners. Firstly, it provides an opportunity for capital appreciation. When investors buy shares of a company at a lower price and sell them later at a higher price, they can generate profits. Additionally, many companies pay dividends to their shareholders, offering a regular income stream. Furthermore, the stock market allows for portfolio diversification, spreading risk across different assets and industries.

History and Need: The history of the stock market dates back centuries, with its roots in trading activities in ancient civilizations. Over time, it evolved into a formalized marketplace where companies could raise capital by issuing shares to investors. This facilitated economic growth by providing businesses with the funds needed to expand operations. The stock market also served as a means for individuals to invest their savings and participate in the growth of successful enterprises.

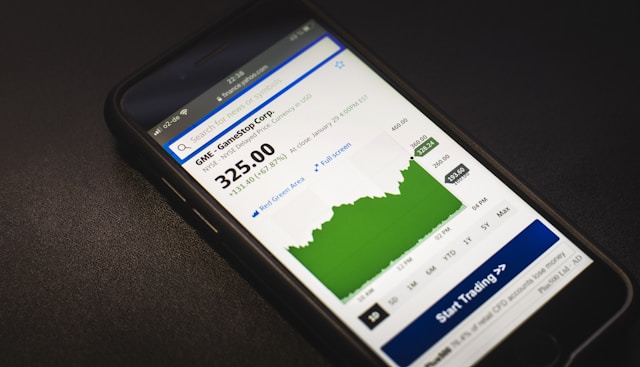

Future Outlooks: Looking ahead, the stock market for beginners holds both promise and challenges. Advancements in technology have made investing more accessible than ever before, with online platforms and mobile apps enabling individuals to trade stocks from anywhere in the world. However, increased access to information and trading tools has also led to greater market volatility and speculative activity. Additionally, regulatory changes and geopolitical uncertainties can impact market dynamics, presenting challenges for novice investors.

Impact on Financial Markets: The stock market plays a pivotal role in shaping the broader financial landscape. Fluctuations in stock prices can have ripple effects throughout the economy, influencing consumer spending, corporate investment decisions, and overall economic growth. Moreover, the stock market serves as a barometer of investor sentiment, reflecting optimism during bull markets and pessimism during bear markets. As such, it is closely monitored by policymakers, economists, and market participants for insights into economic trends and market conditions.

Hurdles: Despite its potential rewards, navigating the stock market can be challenging for beginners. One of the primary hurdles is understanding complex financial concepts and investment strategies. Concepts like valuation metrics, market analysis, and risk management may seem overwhelming to those new to investing. Additionally, managing emotions during market fluctuations can be difficult, as fear and greed can cloud judgment and lead to impulsive decision-making. Moreover, beginners may fall prey to common pitfalls such as chasing hot stocks, timing the market, or succumbing to herd mentality.

Overcoming Hurdles: To overcome these hurdles, beginners should focus on education and developing a sound investment strategy. Learning the fundamentals of investing through books, online courses, and reputable financial websites can provide a solid foundation. It’s also essential to have a clear understanding of one’s financial goals, risk tolerance, and time horizon. By setting realistic expectations and adhering to a disciplined approach, investors can better navigate the ups and downs of the stock market.

Risk Management: Risk management is another critical aspect of successful investing. Beginners should diversify their portfolios across different asset classes and industries to spread risk. Additionally, setting stop-loss orders and maintaining a long-term perspective can help mitigate losses during market downturns. It’s also crucial to avoid investing money that cannot be afforded to lose, as the stock market carries inherent risks.

Emotional Discipline: Emotional discipline is key to successful investing. Fear and greed are common emotions that can lead to irrational decision-making. Beginners should strive to remain objective and rational, focusing on long-term goals rather than short-term fluctuations. Implementing a systematic investment plan and sticking to it can help mitigate the impact of emotions on investment decisions.

Research and Analysis: Conducting thorough research and analysis is essential for making informed investment decisions. Beginners should analyze company fundamentals, including financial statements, earnings reports, and growth prospects. They should also stay abreast of market trends, economic indicators, and geopolitical developments that may impact their investments. Utilizing research tools and seeking advice from financial professionals can aid in the decision-making process.

Seeking Guidance: Seeking guidance from experienced investors or financial advisors can provide valuable insights and mentorship for beginners. Learning from those who have successfully navigated the stock market can help shorten the learning curve and avoid common mistakes. Financial advisors can also provide personalized investment advice tailored to individual goals, risk tolerance, and financial circumstances.

Continuous Learning: Finally, operating in the stock market is an ongoing learning process. Markets evolve, economies change, and new opportunities emerge over time. Therefore, beginners should remain curious and committed to continuous learning and self-improvement. Investing in the stock market works by staying informed, adapting to changing market conditions, and refining their investment strategies, investors can increase their chances of long-term success in the stock market.

Stock market a beginners guide

A case study on how to invest in stocks

Investing in blue-chip, long-lasting stocks can be a prudent strategy for beginners. These companies are typically well-established, financially stable, and have a track record of consistent performance. By studying the behavior of such stocks, beginners can gain valuable insights into fundamental investment principles and learn important lessons that can help guide their investment journey.

One iconic example of a blue-chip stock is Coca-Cola (NYSE: KO). Founded in 1886, Coca-Cola has grown into one of the world’s largest beverage companies, with a portfolio of over 500 brands and operations in more than 200 countries. What sets Coca-Cola apart as a long-lasting stock is its enduring brand strength, global distribution network, and consistent dividend payments. For beginners, Coca-Cola serves as a prime example of the power of branding and the resilience of companies with strong competitive advantages.

Another exemplary blue-chip stock is Johnson & Johnson (NYSE: JNJ). As a diversified healthcare conglomerate, Johnson & Johnson operates in three main segments: pharmaceuticals, medical devices, and consumer health products. With a history dating back to 1886, the company has weathered numerous economic cycles and regulatory challenges, yet it has consistently delivered value to shareholders through innovation and strategic acquisitions. For beginners, Johnson & Johnson exemplifies the importance of diversification across multiple business lines and the potential for long-term growth in defensive sectors like healthcare.

Microsoft Corporation (NASDAQ: MSFT) stands out as a leading technology blue-chip stock with a legacy of innovation and market dominance. Founded in 1975 by Bill Gates and Paul Allen, Microsoft revolutionized the personal computing industry with its Windows operating system and Office productivity suite. Over the years, the company has successfully transitioned into cloud computing, artificial intelligence, and other high-growth areas, solidifying its position as a market leader. For beginners, Microsoft illustrates the importance of adaptability and continuous innovation in staying ahead of the curve in rapidly evolving industries.

Procter & Gamble (NYSE: PG) is another blue-chip stock with a rich history and a global presence in consumer goods. Founded in 1837, Procter & Gamble manufactures and sells a wide range of household products, including cleaning agents, personal care items, and pet foods. Despite facing stiff competition and changing consumer preferences, the company has maintained its market leadership through a combination of product innovation, brand management, and strategic acquisitions. For beginners, Procter & Gamble offers lessons in brand management, consumer behavior, and the resilience of companies with diverse product portfolios.

Apple Inc. (NASDAQ: AAPL) exemplifies the transformative power of innovation and brand loyalty in the technology sector. Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple has become synonymous with innovation, design excellence, and customer experience. From the revolutionary iPhone to the iconic Macintosh computer, Apple has consistently pushed the boundaries of technology and redefined entire industries. For beginners, Apple’s success underscores the importance of visionary leadership, product differentiation, and cultivating a loyal customer base.

Walt Disney Company (NYSE: DIS) is a prime example of a blue-chip stock in the entertainment and media industry. Founded in 1923 by Walt Disney and Roy O. Disney, the company has become a global powerhouse in film, television, theme parks, and consumer products. Disney’s enduring appeal lies in its iconic brands, timeless storytelling, and ability to create immersive entertainment experiences that resonate with audiences of all ages. For beginners, Disney offers lessons in brand building, content creation, and the importance of diversification in the entertainment business.

These blue-chip stocks share common characteristics that make them attractive investments for beginners. They have a history of strong financial performance, a competitive advantage in their respective industries, and a proven track record of delivering value to shareholders. By studying the behavior of these stocks over time, beginners can gain valuable insights into fundamental investment principles such as diversification, long-term growth, and risk management. Moreover, they can learn important lessons about the power of innovation, brand management, and strategic vision in driving sustainable success in the stock market. Ultimately, investing in blue-chip, long-lasting stocks can provide beginners with a solid foundation for building wealth and achieving their financial goals over time.

Your Average Investor links

- Series 7

- Series 24

- Insurance Planning

- Financial Management

- Tax Planning

- Special Situation Planning

- 2024 Stock Market Holidays

- Stock market Crash 1929

References:

- How To Start Investing in Stocks in 2024 – Investopedia1

- Stock Market Basics for Beginners – The Motley Fool2

- Stock Market Basics: 9 Tips For Beginners | Bankrate3