Unlocking Financial Success: 4 Practical Steps to the Goal of Financial Plans

Table of Contents

Introduction

As an average investor, understanding how to set and track financial goals is essential for building a secure future. In this blog post, we’ll explore actionable steps to help you achieve your financial milestones without overwhelming jargon or complex strategies.

1. Goal of Financial Plan

Setting clear financial goals provides direction and motivation. If you approach your financial planning from the standpoint of what your money can do for you — whether that’s buying a house or helping you retire early — you’ll make saving feel more intentional. Make your financial goals inspirational.

2. Crafting Your Financial Plan

A financial plan is a comprehensive picture of your current finances, your financial goals, and any strategies you’ve set to achieve those goals. It includes details about your cash flow, savings, debt, investments, insurance, and other elements of your financial life. Here are the essential steps:

- Set Financial Goals: Define your objectives. Whether it’s saving for retirement, paying off debt, or buying a home, quantify your goals and make them inspirational.

- Track Cash Flow: Understand your income and expenses. Create a budget to manage your money effectively.

- Build Emergency Funds: Prioritize saving for unexpected expenses. Aim for at least three to six months’ worth of living expenses.

- Pay Down Debt: Tackle high-interest debts systematically. It’s a crucial step toward financial freedom.

- Invest Wisely: Diversify your investments and consider long-term growth potential.

- Review Annually: Revisit your goals and adjust your plan as needed.

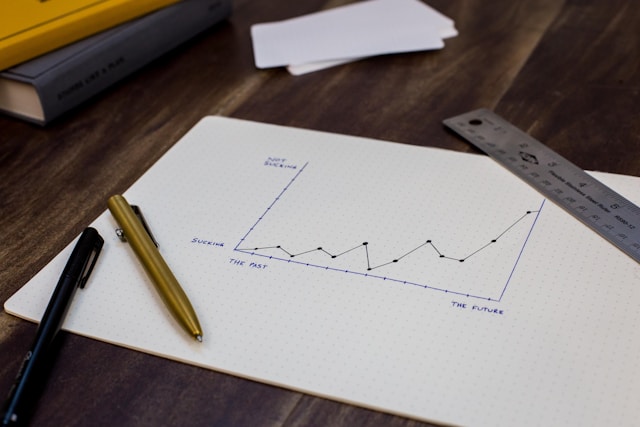

3. Visualizing Progress

- Mobile Apps: Use budgeting apps like YNAB or EveryDollar to track your progress.

- Spreadsheets: Create a simple spreadsheet to monitor income, expenses, and goal contributions.

- Visual Trackers: Graphs and charts help visualize your financial journey.

4. Celebrate Your Wins

- Small Victories Matter: Celebrate each milestone, whether it’s paying off a credit card or hitting a savings target.

- Positive Reinforcement: Reward yourself (within reason) when you achieve a goal. It reinforces good financial habits.

Remember, financial success is a journey, not a sprint. By setting clear goals, tracking diligently, and celebrating progress, you’ll build a solid foundation for your financial future.

Overview of Financial Planning Goals

The primary goal of financial plan is to provide a structured roadmap for achieving financial stability and growth. It involves setting specific, measurable objectives that align with an individual’s or organization’s long-term financial aspirations. This structured approach helps in making informed financial decisions.

Utility of Financial Planning Goals

The goal of financial plan is useful because it provides clarity and direction. It helps individuals and businesses prioritize their financial activities and allocate resources efficiently. Additionally, it fosters financial discipline and accountability, ensuring that goals are met systematically.

History of Financial Planning Goals

The concept of setting a goal of financial plan has evolved from basic budgeting practices to comprehensive financial planning. Historically, people used simple budgeting methods to manage their finances. Over time, the increasing complexity of financial products and markets necessitated more sophisticated planning and goal-setting techniques.

Emergence of Financial Planning Goals

The goal of financial plan emerged as financial markets and personal finance management grew more complex. With the advent of new financial products and investment opportunities, there was a need for a structured approach to managing finances. This led to the development of financial planning as a profession and the formalization of financial goals.

Necessity of Financial Planning Goals

The necessity of a goal of financial plan arises from the need to navigate financial uncertainties and achieve long-term financial security. Without clear goals, it’s easy to make impulsive financial decisions that can derail progress. Financial planning goals provide a clear path and help individuals stay focused on their financial objectives.

Future Outlook on Financial Planning Goals

The future of the goal of financial plan looks promising with advancements in technology and financial literacy. Emerging technologies like artificial intelligence and machine learning are expected to enhance personalized financial planning. These advancements will make setting and achieving financial goals more accessible and efficient.

Impact on Financial Markets

The goal of financial plan impacts financial markets by promoting disciplined investment behaviors. When individuals and organizations have clear financial goals, they are more likely to make informed and strategic investment decisions. This contributes to market stability and can drive economic growth.

Hurdles in Financial Planning Goals

Despite its benefits, setting and achieving the goal of financial plan faces several hurdles. One major challenge is a lack of financial literacy, which can hinder individuals from effectively setting and pursuing their financial goals. Additionally, economic volatility and unforeseen life events can disrupt financial plans.

Adoption and Trends in Financial Planning Goals

The adoption of the goal of financial plan has increased with the availability of digital tools and financial education. Mobile apps and online platforms have made it easier for individuals to set and track their financial goals. Current trends indicate a growing interest in integrated financial planning solutions that offer comprehensive goal-setting features.

Educational Efforts and Financial Planning Goals

Educational efforts are crucial for promoting the importance of the goal of financial plan. Financial literacy programs in schools, workplaces, and communities aim to teach individuals how to set and achieve their financial goals. These initiatives empower people to take control of their financial futures.

Role of Financial Advisors in Financial Planning Goals

Financial advisors play a key role in helping individuals set and achieve the goal of financial plan. They provide expert guidance and tools for setting realistic and achievable financial goals. Advisors also help clients adjust their plans as needed to stay on track.

Technological Innovations in Financial Planning Goals

Technological innovations are transforming the goal of financial plan by providing more accurate and user-friendly tools. Apps and software now offer automated financial planning, personalized advice, and real-time tracking of financial goals. These technologies are making financial planning more efficient and accessible to a broader audience.

The profession of financial planning and the establishment of the goal of financial plan have deep roots in history, evolving significantly over time. This evolution has been driven by the increasing complexity of financial markets and the need for structured financial management. The primary goal of financial plan is to provide a clear and organized path for individuals and businesses to achieve financial stability and growth, ensuring that resources are allocated efficiently and effectively.

Origins and Early History

The origins of financial planning can be traced back to the early 20th century, when the concept of personal finance began to take shape. During this time, financial management was primarily focused on budgeting and saving. People used simple methods, such as ledgers and notebooks, to keep track of their income and expenses. The goal of financial plan was basic and centered around ensuring that immediate financial needs were met, such as paying bills and saving for short-term goals.

As financial markets and products began to grow in complexity, the need for more sophisticated financial planning became evident. The stock market crash of 1929 and the subsequent Great Depression highlighted the importance of having a structured approach to financial management. This period saw the rise of professional financial advisors who could help individuals navigate the turbulent financial landscape. The goal of financial plan during this era expanded to include not only short-term needs but also long-term financial security and investment strategies.

Emergence as a Profession

The formalization of financial planning as a profession began in the 1960s and 1970s. During this time, the concept of comprehensive financial planning was introduced, emphasizing the importance of setting and achieving long-term financial goals. The establishment of the International Association for Financial Planning (IAFP) in 1969 and the Certified Financial Planner (CFP) Board of Standards in 1985 marked significant milestones in the profession’s development. These organizations set standards for education, ethics, and practice, ensuring that financial planners had the necessary skills and knowledge to help clients achieve their financial goals.

The goal of financial plan became more structured and holistic, encompassing various aspects of financial management, including retirement planning, tax planning, estate planning, and risk management. Financial planners began to use sophisticated tools and techniques to help clients set realistic and achievable financial goals, track their progress, and make necessary adjustments. The profession’s growth was driven by the increasing complexity of financial markets and the need for individuals to have a comprehensive approach to managing their finances.

Utilization and Benefits

The goal of financial plan is utilized for several key reasons. First, it provides clarity and direction. By setting specific, measurable objectives, individuals and businesses can prioritize their financial activities and allocate resources efficiently. This structured approach helps to ensure that financial decisions are aligned with long-term goals, reducing the risk of impulsive or short-sighted actions.

Second, the goal of financial plan fosters financial discipline and accountability. Regularly monitoring progress towards financial goals encourages individuals to stay focused and make informed decisions. This ongoing assessment helps to identify areas that need adjustment and reinforces positive financial behaviors, contributing to long-term financial stability and growth.

Third, the goal of financial plan offers peace of mind. Having a clear plan and regularly tracking progress provides a sense of control over one’s financial future. This confidence can reduce anxiety related to financial matters and improve overall well-being.

Past, Present, and Future Outlook

In the past, the goal of financial plan was primarily focused on budgeting and saving for immediate needs. Financial planning was a manual and time-consuming process, often limited to those with the knowledge and resources to manage their finances meticulously. The introduction of personal computing in the 1980s and 1990s revolutionized financial planning by enabling more sophisticated methods of data organization and analysis. Financial software, such as spreadsheets and early budgeting tools, provided individuals and businesses with the ability to set and monitor financial goals more effectively.

Today, the goal of financial plan is more accessible and comprehensive than ever. The rise of financial technology (fintech) has led to the development of a wide range of tools and applications designed to simplify the planning and tracking process. Mobile apps, online platforms, and robo-advisors provide users with real-time insights into their financial progress, automatic categorization of expenses, and personalized advice based on their goals and financial situation. These advancements have lowered the barriers to entry, enabling more people to engage in effective financial planning.

Looking ahead, the future of the goal of financial plan is likely to be shaped by continued technological innovation and changing investor preferences. Artificial intelligence (AI) and machine learning are expected to play a larger role in providing personalized financial advice and automating tracking processes. These technologies can analyze vast amounts of financial data to identify patterns and trends, providing users with more accurate and actionable insights. Additionally, AI-powered tools can adjust financial plans in real-time, responding to changes in market conditions and individual circumstances.

Furthermore, the integration of behavioral finance into the goal of financial plan is expected to gain prominence. Behavioral finance examines the psychological factors that influence financial decision-making. By understanding these factors, financial planning tools can be designed to account for biases and improve user outcomes. For example, automated nudges and reminders can help individuals stay on track with their financial goals, reinforcing positive behaviors and discouraging detrimental ones.

Impact on Financial Markets

The goal of financial plan impacts financial markets by promoting disciplined investment behaviors. When individuals and businesses have clear financial goals, they are more likely to make informed and strategic investment decisions. This contributes to market stability and can enhance overall economic growth. Well-structured financial plans can also help to mitigate the impact of market volatility by providing a clear framework for making adjustments and managing risks.

Hurdles in Financial Planning Goals

Despite its benefits, achieving the goal of financial plan faces several hurdles. One significant challenge is financial literacy. Many individuals lack the basic knowledge and skills needed to effectively set and pursue their financial goals. This gap underscores the importance of financial education and literacy programs, which can empower individuals to take control of their financial futures.

Another challenge is the economic environment. Economic volatility, such as recessions, inflation, and market fluctuations, can disrupt financial plans and create uncertainty. Financial planners and planning tools must develop strategies that are resilient to these conditions, ensuring that clients can navigate economic turbulence and stay on course to achieve their goals.

Additionally, privacy and security concerns can be a barrier to the adoption of digital financial planning tools. Individuals need to trust that their financial data is secure and that their privacy is protected. Ensuring robust security measures and transparent data practices is essential for the continued growth and success of digital financial planning solutions.

In conclusion, the profession of financial planning and the establishment of the goal of financial plan have evolved significantly over time, adapting to the increasing complexity of financial markets and the need for structured financial management. The development of financial planning as a profession has been driven by the necessity of helping individuals and businesses achieve financial stability and growth. As technology continues to advance, the goal of financial plan will become even more accessible, personalized, and effective. Despite the challenges, the future of financial planning is bright, with innovations poised to make it an integral part of achieving financial stability and prosperity.

It’s crucial to understand how to set financial goals that are specific, measurable, achievable, relevant, and time-bound (SMART).

Understanding financial goals how to set them involves outlining clear objectives aligned with your long-term financial aspirations.

Learning the process of goals how to set financial ones ensures you can prioritize and achieve milestones effectively.

Setting SMART financial goals helps ensure that your financial planning is strategic and results-oriented.

Key Factors to Consider:

1. Market Capitalization:

- Stocks with large market capitalizations tend to have a greater impact on the overall market indices. Companies like Apple, Microsoft, and Amazon, with market caps in the trillions, can influence broader market movements significantly.

2. Sector Performance:

- Different sectors perform differently based on economic conditions and industry-specific factors. Technology stocks (e.g., Apple, Microsoft) may thrive during periods of innovation and digital transformation, while energy stocks (e.g., ExxonMobil, Chevron) are influenced by commodity prices and global demand.

3. Earnings Reports:

- Quarterly earnings reports can cause significant price movements. Positive earnings surprises often lead to stock price increases, while missed expectations can result in declines. Investors should track earnings announcements and analyze how they align with market expectations.

4. Economic Indicators:

- Economic indicators such as GDP growth, inflation rates, and employment data can impact stock prices. Companies sensitive to economic cycles, like consumer discretionary stocks (e.g., Amazon, Tesla), may see fluctuating prices based on economic trends.

5. Geopolitical Events:

- Geopolitical events such as trade tensions, regulatory changes, and geopolitical conflicts can affect stock markets globally. Stocks of companies with international exposure may be particularly sensitive to geopolitical developments.

Stocks Impacting Criteria:

1. Technology Stocks:

- Companies like Apple (AAPL) and Microsoft (MSFT) are leaders in the technology sector, influencing market trends through innovations in hardware, software, and cloud computing. Investors should monitor technological advancements and competitive landscapes.

2. Consumer Discretionary Stocks:

- Stocks such as Amazon (AMZN) and Tesla (TSLA) are notable in the consumer discretionary sector. Changes in consumer spending habits and market trends can significantly impact their stock prices.

3. Energy Stocks:

- Energy companies like ExxonMobil (XOM) and Chevron (CVX) are pivotal due to their influence on energy prices and global economic activities. Investors should follow developments in energy policies, OPEC decisions, and renewable energy trends.

4. Financial Sector Stocks:

- Banks and financial institutions, including JPMorgan Chase (JPM) and Goldman Sachs (GS), play a crucial role in market movements. Interest rate changes, regulatory reforms, and economic stability impact financial stocks.

5. Healthcare Stocks:

- Companies like Pfizer (PFE) and Moderna (MRNA) are significant in the healthcare sector, particularly during health crises and periods of pharmaceutical innovation. Regulatory approvals, drug pipelines, and healthcare policy changes affect these stocks.

What to Look For:

1. Fundamental Analysis:

- Conduct thorough research using fundamental analysis, examining factors such as revenue growth, earnings per share (EPS), debt levels, and market position. Understanding a company’s financial health helps assess its potential for growth or stability.

2. Technical Analysis:

- Utilize technical analysis to study historical price trends, trading volumes, and technical indicators (e.g., moving averages, relative strength index). These insights can guide entry and exit points for investments.

3. Diversification:

- Diversify your portfolio across different sectors and asset classes to mitigate risk. Avoid overexposure to a single stock or sector, as concentrated positions can amplify losses during market downturns.

4. Long-Term Perspective:

- Adopt a long-term investment horizon and avoid making decisions based solely on short-term market fluctuations. Focus on companies with strong fundamentals and competitive advantages that align with your financial goals.

5. Risk Management:

- Implement risk management strategies, such as setting stop-loss orders and regularly reviewing your portfolio’s performance. Stay informed about market developments and adjust your investment strategy accordingly.

What to Be Cautious About:

1. Volatility:

- High volatility stocks can lead to substantial gains or losses. Exercise caution when investing in volatile stocks, particularly those influenced by speculative trading or market sentiment.

2. Market Timing:

- Attempting to time the market can be challenging and risky. Instead of trying to predict short-term price movements, focus on consistent investment strategies based on thorough analysis and research.

3. Financial Health:

- Be wary of companies with excessive debt, declining revenues, or management issues. Poor financial health can jeopardize a company’s long-term prospects and lead to stock price declines.

4. External Factors:

- Monitor external factors such as regulatory changes, geopolitical tensions, and macroeconomic trends. These factors can impact stock prices unpredictably and require proactive risk management.

5. Emotional Investing:

- Avoid emotional decision-making based on fear or greed. Stick to your investment plan and remain disciplined during market fluctuations to achieve long-term financial success.

Your Average Investor Links

- Series 7

- Series 24

- Insurance Planning

- Financial Management

- Tax Planning

- Special Situation Planning

- CFA vs CFP Showdown

- Series 65

- Financial Freedom

- Financial Planning Pyramid

- Debt to income ratio

- Mastering the Financial Planning Domains

- Why did the Nasdaq Drop in May?

- What is Financial Planning

- The Process of Financial Planning

- 9 Levels of Financial Planning

- Debt Snowball? What does that mean!