10 Realistic Financial Goals Examples Every Investor Can Achieve

Table of Contents

Introduction

Financial goals examples are like little ships navigating the vast sea of personal finance. Whether you’re a seasoned investor or just dipping your toes into the financial waters, setting clear objectives is crucial. In this article, we’ll explore ten practical financial goals that anyone can achieve. No jargon, no hyperlinks—just straightforward advice to help you sail toward financial success.

1. Make a Budget

Before you set sail, you need a map. Creating a budget is your financial compass. List your income and expenses to understand what you’re working with. A credit counselor can guide you through this process and help you create a realistic plan1.

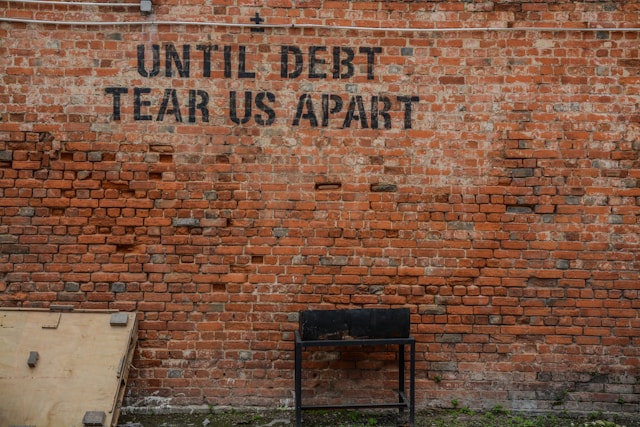

2. Pay Off Credit Card Debt

Credit cards can be treacherous waters. High-interest rates can sink your financial ship. Consider a debt consolidation plan to navigate away from the credit card debt muck. A counselor can explain how it works and help you decide if it’s right for you1.

3. Start an Emergency Fund

Storms happen—unexpected expenses, job loss, or medical crises. An emergency fund is your lifeboat. Aim for three to six months’ worth of living expenses. It’s your safety net when the unexpected hits.

4. Save for Retirement

Picture your golden years on a tranquil island. To get there, contribute to retirement accounts like a 401(k) or IRA. The earlier you start, the smoother your retirement voyage will be.

5. Build an Investment Portfolio

Investing is like exploring uncharted territories. Diversify your portfolio with stocks, bonds, and real estate. Seek advice from reliable sources like Bloomberg, Investopedia, and Seeking Alpha1.

6. Buy a Home

Owning a home anchors you in financial stability. Save for a down payment, explore mortgage options, and set sail toward homeownership.

7. Fund Your Kids’ College Education

Investing in education is an investment in the future. Start a 529 plan or other college savings account to help your kids set sail toward higher learning.

8. Boost Your Net Worth

Calculate your net worth (assets minus liabilities). Aim to increase it over time. As your ship grows, so does your financial security.

9. Achieve Financial Independence

Imagine a life where work is optional. Achieving financial independence means having enough passive income to cover your expenses. Set sail toward financial freedom.

10. Give Back

Generosity is a powerful wind in your financial sails. Whether through charitable donations or volunteering, make a positive impact on others.

Financial Goals Examples: An Overview

Financial goals examples refer to specific objectives individuals or businesses set to achieve financial stability, growth, and security. These goals serve as benchmarks for managing finances effectively and planning for future needs.

Why Financial Goals Examples are Useful

Financial goals examples are useful because they provide clarity and direction in financial planning. They help individuals prioritize spending, save systematically, and track progress towards achieving larger financial objectives. By setting clear goals, individuals can make informed financial decisions that align with their long-term aspirations.

History of Financial Goals Examples

The concept of setting financial goals dates back to ancient civilizations where people engaged in basic forms of saving and wealth accumulation. Over time, as economies evolved and trade expanded, individuals and businesses began formalizing financial planning to manage resources effectively. This historical evolution laid the foundation for modern-day financial goal-setting practices.

Why Financial Goals Examples Came to Be

Financial goals examples emerged from the need to manage finances systematically and prepare for future expenses and investments. As societies became more complex, individuals required structured approaches to saving, investing, and managing debt. Financial goals examples provide a framework for achieving financial independence and resilience against economic uncertainties.

Why Financial Goals Examples Were Needed

Financial goals examples were needed to counteract impulsive spending and financial instability. They promote disciplined financial behavior, encourage savings habits, and facilitate long-term wealth accumulation. Setting specific examples of financial goals helps individuals and businesses navigate financial challenges and achieve desired milestones.

Future Outlook on Financial Goals Examples

The future outlook on financial goals examples is optimistic, driven by advancements in technology and increased financial literacy. Digital tools and apps make it easier for individuals to set, monitor, and adjust financial goals in real-time. The integration of artificial intelligence (AI) and machine learning in financial planning is expected to personalize goal-setting strategies and enhance financial decision-making capabilities.

Impact on Financial Markets

Financial goals examples impact financial markets by influencing investor behavior and market demand for various financial products. Goals related to retirement planning, education savings, and wealth management drive investment flows into stocks, bonds, mutual funds, and other assets. This, in turn, affects asset prices, market liquidity, and overall economic stability.

Hurdles to Achieving Financial Goals Examples

One of the main hurdles to achieving financial goals examples is inadequate financial literacy. Many individuals lack the knowledge and skills to set realistic goals, manage investments effectively, and navigate financial markets. Economic volatility, market uncertainties, and unexpected life events can also disrupt goal achievement and require adaptive financial planning strategies.

Technological Advancements

Technological advancements play a crucial role in shaping the evolution of financial goals examples. Online platforms, robo-advisors, and financial planning software enable individuals to automate savings, optimize investment portfolios, and receive personalized financial advice. These innovations democratize access to financial planning tools and empower individuals to take control of their financial futures.

Economic Implications

Economically, achieving financial goals examples contributes to individual financial stability and overall economic growth. When individuals save and invest wisely, they contribute to capital formation and stimulate economic activity. Financially secure individuals are better positioned to withstand economic downturns and support sustainable economic development.

Social Impacts

Socially, setting and achieving financial goals examples promote financial well-being and reduce financial stress among individuals and families. It fosters a sense of financial empowerment, enabling people to pursue personal aspirations, support charitable causes, and contribute positively to their communities. Financially literate societies are more resilient and inclusive, bridging socioeconomic gaps and promoting economic equality.

Challenges and Considerations

Challenges in achieving financial goals examples include behavioral biases, such as overconfidence or fear of risk, that can hinder decision-making. Regulatory changes, tax implications, and global economic trends also influence goal attainment strategies. Addressing these challenges requires ongoing education, adaptive planning strategies, and leveraging technological innovations to optimize financial outcomes.

In summary, financial goals examples are instrumental in guiding individuals and businesses towards financial success and security. They provide a roadmap for managing finances, making informed decisions, and adapting to changing economic landscapes. By setting clear examples of financial goals, individuals can navigate challenges, seize opportunities, and achieve long-term financial well-being.

The profession of setting and achieving financial goals has evolved significantly over time, reflecting broader societal changes, economic developments, and advancements in financial theory and practice. This evolution can be traced back to ancient civilizations where rudimentary forms of financial planning and goal-setting emerged in response to basic economic needs and societal structures.

Origins and Early History

The origins of financial goal-setting can be seen in ancient Mesopotamia and Egypt, where early forms of record-keeping and accounting emerged to track agricultural yields, taxes, and trade transactions. These early practices laid the groundwork for basic financial planning, which primarily focused on managing resources for immediate survival and wealth accumulation. In ancient Greece and Rome, rudimentary forms of insurance and retirement funds began to appear, marking early attempts at long-term financial planning.

Emergence of Modern Financial Planning

Modern financial planning as a profession began to take shape in the late 19th and early 20th centuries, influenced by economic upheavals such as the Great Depression and World Wars. These events underscored the need for more systematic approaches to financial management, risk mitigation, and long-term savings. During this period, concepts such as asset allocation, portfolio diversification, and retirement planning started to gain prominence among economists, financial advisors, and policymakers.

Utilization and Importance

The profession of financial goal-setting is utilized today by individuals, businesses, and institutions to achieve a wide range of financial objectives. For individuals, setting specific financial goals—such as retirement planning, education funding, debt management, and wealth accumulation—provides clarity and direction in managing personal finances. Businesses utilize financial planning to optimize cash flow, manage capital investments, and navigate economic uncertainties. Institutional investors and asset managers employ sophisticated goal-setting strategies to align investment portfolios with client objectives and regulatory requirements.

Past Perspectives

Historically, financial goal-setting was predominantly a manual process, relying on basic financial models and personal expertise. Financial advisors and planners worked closely with clients to establish goals, assess risk tolerance, and develop customized financial plans. The focus was often on short-term financial objectives and immediate financial needs rather than long-term wealth accumulation and sustainability.

Current Practices

In the present day, financial goal-setting has evolved significantly with advancements in technology, data analytics, and behavioral finance. Financial advisors utilize sophisticated software and algorithms to analyze clients’ financial situations, project future cash flows, and recommend optimal investment strategies. These tools enable advisors to offer personalized advice, monitor goal progress in real-time, and adjust financial plans as needed to adapt to changing market conditions and client circumstances.

Future Outlook

Looking forward, the future outlook for financial goal-setting is shaped by ongoing technological innovation, regulatory changes, and demographic shifts. The integration of artificial intelligence (AI) and machine learning in financial planning software is expected to revolutionize the profession, enabling more accurate financial projections, automated investment decisions, and personalized client experiences. Advances in data privacy and cybersecurity will also play a critical role in safeguarding sensitive financial information and maintaining client trust.

Impact on Financial Markets

Financial goal-setting has a profound impact on financial markets by influencing investor behavior, capital allocation decisions, and market dynamics. Goals related to retirement planning, education savings, and sustainable investing drive demand for various financial products and services, shaping asset prices, market liquidity, and overall economic stability. Institutional investors and asset managers play a pivotal role in market efficiency and liquidity management through goal-aligned investment strategies and risk management practices.

Challenges and Considerations

Despite its benefits, financial goal-setting faces several challenges in practice. One of the primary hurdles is the complexity of financial systems and products, which can overwhelm individuals and businesses without adequate financial literacy and expertise. Behavioral biases, such as overconfidence or fear of risk, can also impact decision-making and hinder goal attainment. Economic volatility, regulatory changes, and geopolitical uncertainties further complicate financial planning efforts, requiring adaptive strategies and ongoing education to navigate successfully.

In conclusion, the profession of financial goal-setting has evolved from rudimentary practices in ancient civilizations to sophisticated, technology-driven approaches in the modern era. Its origins lie in the fundamental human need to manage resources effectively and plan for the future amidst economic uncertainties. As technology continues to advance and demographic shifts reshape global economies, the future of financial goal-setting holds promise for more personalized, efficient, and impactful financial planning outcomes. By leveraging technological innovations, behavioral insights, and regulatory advancements, financial professionals can empower individuals and organizations to achieve their financial aspirations and build a secure financial future.

Types of Underlying Stocks

- Blue-Chip Stocks: These are shares of large, well-established companies with a history of stable earnings, strong balance sheets, and often pay dividends. Blue-chip stocks are favored by conservative investors seeking stability and consistent income.

- Growth Stocks: Growth stocks belong to companies that exhibit above-average growth potential in revenue and earnings. These companies typically reinvest profits into expanding operations rather than paying dividends, appealing to investors seeking capital appreciation.

- Dividend Stocks: Dividend-paying stocks distribute a portion of their earnings to shareholders regularly. These stocks are attractive to income-oriented investors looking for a steady stream of income in addition to potential capital gains.

- Value Stocks: Value stocks are shares of companies considered undervalued relative to their intrinsic worth based on metrics like price-to-earnings (P/E) ratio or price-to-book (P/B) ratio. Value investors aim to capitalize on market inefficiencies and expect the stock’s price to rise as the market corrects its valuation.

- Sector-Specific Stocks: Stocks can also be categorized by sector, such as technology, healthcare, consumer goods, energy, and finance. Each sector has unique characteristics and responds differently to economic cycles and market conditions.

Examples of intermediate financial goals include saving for a down payment on a home and building an emergency fund to cover six months of expenses.

Additionally, examples of mid term financial goals could involve paying off high-interest debt within three to five years and funding a child’s college education.

Investment Strategies for Individuals

For individuals, incorporating stocks into their investment strategy involves several considerations:

- Risk Tolerance: Understanding one’s risk tolerance is crucial in selecting stocks. Conservative investors may prefer blue-chip and dividend stocks for stability, while aggressive investors may focus on growth stocks for higher potential returns despite higher volatility.

- Time Horizon: The length of time an investor plans to hold investments influences stock selection. Long-term investors can tolerate market fluctuations and benefit from compounding returns, whereas short-term investors may focus more on market timing and volatility.

- Diversification: Diversifying across different types of stocks and sectors helps mitigate risk. A well-diversified portfolio reduces exposure to the performance of any single stock or industry and enhances overall portfolio stability.

- Financial Goals: Aligning stock investments with financial goals such as retirement planning, education funding, or wealth accumulation is crucial. Different types of stocks may be suitable for different goals, requiring a tailored approach to portfolio construction.

Business Investment Strategies

Businesses often invest in stocks as part of their treasury management or surplus cash utilization strategies. Considerations include:

- Cash Flow Management: Businesses invest surplus cash in stocks to generate additional income or potential capital gains. Managing cash effectively ensures liquidity while optimizing returns on idle cash reserves.

- Strategic Investments: Investing in stocks of suppliers, partners, or competitors can strengthen strategic relationships and provide insights into market trends and competitive dynamics.

- Risk Mitigation: Diversifying investments across stocks with varying risk profiles helps businesses manage financial risk and maximize returns on investment. Strategic diversification safeguards against adverse market movements and economic uncertainties.

Forward-Thinking Investment Profiles

Forward-thinking investors consider emerging trends and macroeconomic factors when selecting stocks:

- Technological Innovation: Investing in technology stocks leverages advancements in artificial intelligence, cloud computing, and digital transformation driving industry disruption and growth.

- Sustainability: Increasing focus on environmental, social, and governance (ESG) criteria influences investment decisions towards companies promoting sustainable practices and ethical governance.

- Globalization: Investing in multinational corporations and emerging markets captures opportunities arising from global economic growth, demographic shifts, and expanding consumer markets.

- Sector Rotation: Monitoring sector trends and economic cycles helps investors capitalize on sectors poised for growth, such as renewable energy, healthcare innovation, and digital infrastructure.

Considerations for All Investors

Regardless of investor type, several key considerations apply to stock investments:

- Research and Due Diligence: Conducting thorough research and due diligence is essential before investing in any stock. This includes analyzing financial statements, understanding industry dynamics, and evaluating company management.

- Risk Management: Implementing risk management strategies, such as diversification and asset allocation, helps mitigate portfolio volatility and protect against market downturns.

- Long-Term Perspective: Adopting a long-term investment perspective allows investors to ride out short-term market fluctuations and benefit from compounding returns over time.

- Adaptability and Monitoring: Markets are dynamic, requiring investors to adapt to changing economic conditions, regulatory environments, and technological advancements. Regularly monitoring portfolio performance and adjusting investments as needed ensures alignment with evolving goals and market trends.

In conclusion, incorporating stocks into investment portfolios requires careful consideration of individual risk tolerance, financial goals, and market conditions. For individuals, stocks offer opportunities for growth and income generation, while businesses utilize stocks strategically to optimize cash flow and manage financial risk. Forward-thinking investors leverage emerging trends and sector-specific opportunities to capitalize on market dynamics and achieve long-term investment success. By understanding how stocks fit into broader investment strategies and aligning investments with financial goals, individuals and businesses can navigate financial markets effectively and build wealth over time.

Your Average Investor Links