Understanding How to Write a Will How to write a will is a topic that many people avoid because it involves facing one’s mortality. However, writing a will […]

Currently browsing: Education

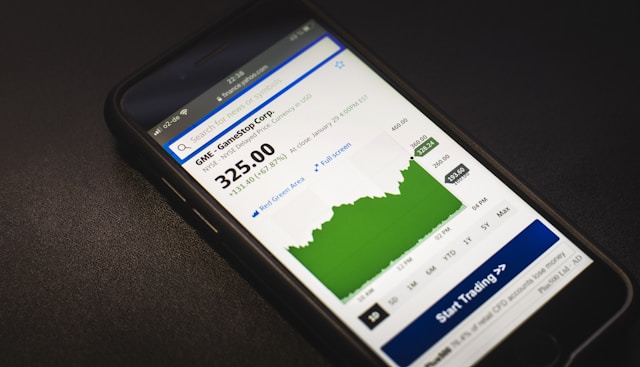

5 Powerful Steps to Master Stocks for Beginners

Stocks for beginners can seem daunting at first, but it doesn’t have to be. The first step is to understand the basics. Stocks represent ownership in a company and constitute a claim on part of the company’s assets and earnings. As you acquire more stocks, your ownership stake in the company becomes greater.

5 Powerful Steps to Master Personal Financial Planning

Step 1: Understand the Basics of Personal Financial Planning Personal Financial Planning is a practice that helps you track and manage your money with the purpose of […]

7 Powerful Strategies for Mastering Investing for Beginners

Investing for beginners can seem daunting at first, but it doesn’t have to be. The first step is to understand the basics. Investing is about putting your money to work for you. Instead of simply saving your money in a bank account, you’re putting it into things like stocks, bonds, or real estate, with the expectation that your money will grow over time.

10 Powerful Steps to Master the Stock Market for Beginners

The stock market is a complex system where shares of publicly-traded companies are issued, bought, and sold. To some it is a nebulous, dark chasm where people gamble. Actually, it is not gambling at all. Let’s take a closer look at the Stock Market for Beginners.

5 Powerful Strategies for Special Situation Planning

Special Situation Planning is a unique approach to investing that revolves around capitalizing on unique and often short-term events or circumstances1. These events, referred to as “special situations,” have the potential to influence the value of a stock, bond, or other financial asset1.

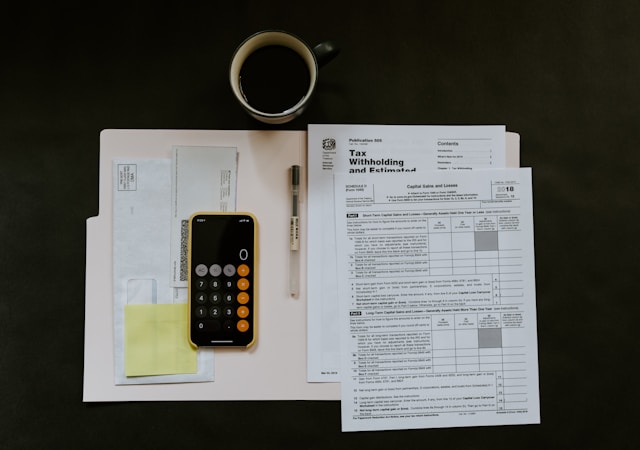

5 Powerful Strategies for Effective Income Tax Planning

Income tax planning is the process of carefully examining and organizing an individual’s or a business’s finances to minimize the amount of taxes owed. The objective of income tax planning is to use legal and financial strategies to stay compliant with tax laws while maximizing savings1.

7 Proven Steps to Master Investment Planning

Investment planning is the process of identifying financial goals and designing a strategy to achieve them through various investment vehicles. It involves assessing risk tolerance, determining the appropriate asset allocation, and selecting investments that align with an individual’s financial objectives. Effective investment planning helps ensure that investments are structured to meet both short-term and long-term goals.

7 Powerful Steps to Master Insurance Planning

Insurance Planning is a critical aspect of financial management. It involves the strategic planning and management of risks associated with potential losses. The process includes evaluating these risks and taking appropriate measures to mitigate them by selecting suitable insurance policies. Insurance Planning is not just about buying an insurance policy; it’s about understanding your financial situation, identifying your insurance needs, and finding the right policy that fits those needs.

5 Powerful Strategies to Master Financial Management

Financial Management is a crucial aspect of any successful business. It involves the strategic planning, organizing, directing, and controlling of financial undertakings in an organization or an institute. It also includes applying management principles to the financial assets of an organization, while also playing an important part in fiscal management.

Recent Posts

- Unlock Your Financial Freedom: 5 Amazing Benefits of Solo 401k

- Examples of Financial Goals: 10 Powerful Insights for Success

- 10 Powerful Steps to Achieve Your Good Financial Goals in 2024

- Achieve Success: 7 Reasons to Prioritize Longterm Financial Goals

- Empower Your Finances: 15 Key Insights on How to Pay Off Debt